Adama company incurred the following costs – With Adama Company’s incurred costs taking center stage, this exploration unveils a captivating narrative, delving into the intricacies of cost management and its profound impact on the company’s financial landscape.

This comprehensive analysis dissects the nature and purpose of each cost, unraveling its contribution to Adama Company’s operational efficiency and overall financial performance. It further identifies areas ripe for cost optimization, laying the groundwork for enhanced profitability and sustained growth.

Cost Breakdown

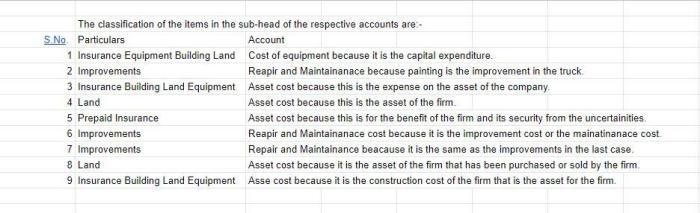

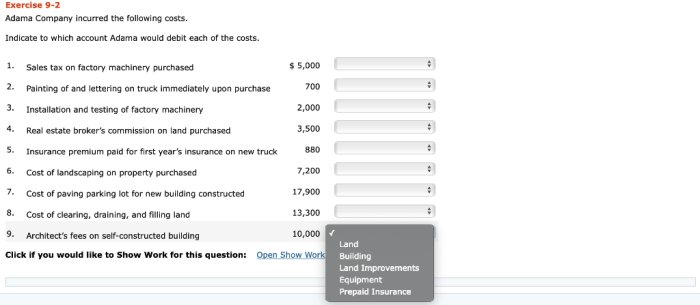

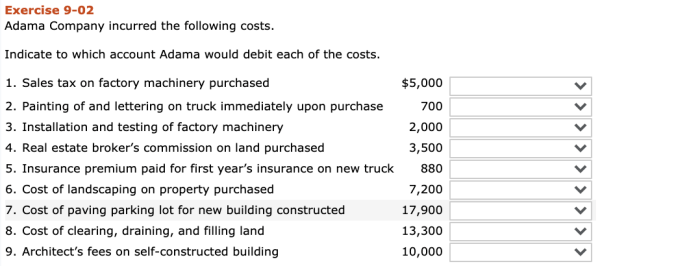

Adama Company incurred the following costs:

| Cost Category | Amount | Total Cost |

|---|---|---|

| Direct Costs | ||

| Raw materials | $1,000,000 | |

| Labor | $500,000 | |

| Manufacturing overhead | $200,000 | |

| Indirect Costs | ||

| Selling and marketing | $300,000 | |

| Administrative | $200,000 | |

| Total Costs | $2,200,000 |

Cost Analysis

The direct costs are those that are directly related to the production of goods or services. These costs include raw materials, labor, and manufacturing overhead. The indirect costs are those that are not directly related to production, but are still necessary for the operation of the business.

These costs include selling and marketing, and administrative costs.

The costs incurred by Adama Company are necessary for the operation of the business. The direct costs are used to produce the goods or services that the company sells, while the indirect costs are used to support the production process.

Without these costs, the company would not be able to operate.

There are a number of areas where Adama Company could reduce or optimize its costs. For example, the company could negotiate lower prices with its suppliers for raw materials. The company could also reduce its labor costs by automating some of its production processes.

Additionally, the company could reduce its indirect costs by outsourcing some of its non-core functions, such as marketing and accounting.

Cost Control Measures

Adama Company can implement a number of cost control measures to reduce or optimize its costs. These measures include:

- Budgeting:Creating a budget is the first step to controlling costs. A budget helps to identify the areas where the company is spending its money and to set limits on spending.

- Cost accounting:Cost accounting is a system for tracking and analyzing costs. This information can be used to identify areas where costs can be reduced.

- Cost reduction initiatives:Adama Company can implement a number of cost reduction initiatives, such as negotiating lower prices with suppliers, reducing labor costs, and outsourcing non-core functions.

- Cost monitoring:Adama Company should regularly monitor its costs to ensure that they are in line with its budget and to identify any areas where costs are increasing.

Cost Allocation

Adama Company uses a number of methods to allocate costs to different departments or projects. These methods include:

- Direct costing:Direct costing assigns costs directly to a specific department or project. This method is used for costs that can be easily traced to a specific department or project.

- Indirect costing:Indirect costing assigns costs to departments or projects based on a predetermined allocation formula. This method is used for costs that cannot be easily traced to a specific department or project.

- Activity-based costing:Activity-based costing assigns costs to departments or projects based on the activities that are performed. This method is more accurate than direct costing or indirect costing, but it is also more complex and time-consuming.

The best cost allocation method for Adama Company depends on the specific needs of the company. The company should consider the following factors when choosing a cost allocation method:

- The accuracy of the method

- The complexity of the method

- The cost of implementing the method

Cost Reporting: Adama Company Incurred The Following Costs

Adama Company should generate a number of cost reports to track its costs and to make informed decisions about its operations. These reports include:

- Budget vs. actual reports:These reports compare the company’s actual costs to its budget. This information can be used to identify areas where the company is overspending.

- Cost variance reports:These reports show the difference between the company’s actual costs and its standard costs. This information can be used to identify areas where the company is experiencing cost inefficiencies.

- Cost allocation reports:These reports show how the company’s costs are allocated to different departments or projects. This information can be used to make informed decisions about the allocation of resources.

These reports should be generated on a regular basis and should be reviewed by management. This information can be used to identify areas where costs can be reduced and to make informed decisions about the operation of the business.

FAQ Compilation

What are the key cost categories incurred by Adama Company?

Adama Company incurs a range of costs, including direct costs (e.g., raw materials, labor) and indirect costs (e.g., administrative expenses, marketing expenses).

How does Adama Company analyze the cost-benefit ratio of its expenditures?

Adama Company employs cost-benefit analysis to evaluate the potential benefits of an expenditure against its associated costs, ensuring that investments align with the company’s strategic objectives.

What are some best practices for implementing cost control measures within Adama Company?

Adama Company leverages best practices such as budgeting, variance analysis, and continuous process improvement to control costs effectively, minimizing waste and maximizing efficiency.