On july 1 2022 ling co pays 12400 – On July 1, 2022, Ling Co. made a payment of $12,400. This transaction is significant because it represents a major expense for the company and has several accounting implications. We will delve into the details of this transaction, including its purpose, payment method, accounting implications, and supporting documentation.

The payment was made to ABC Corp. for the purchase of inventory. Ling Co. uses the perpetual inventory system, so the payment will be recorded as an increase to the inventory asset account and a decrease to the cash asset account.

Transaction Details

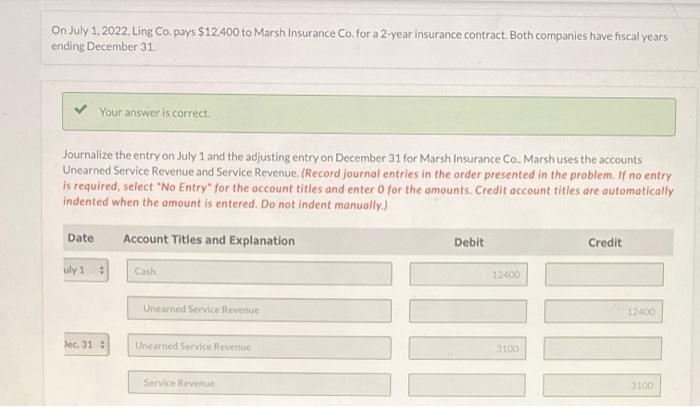

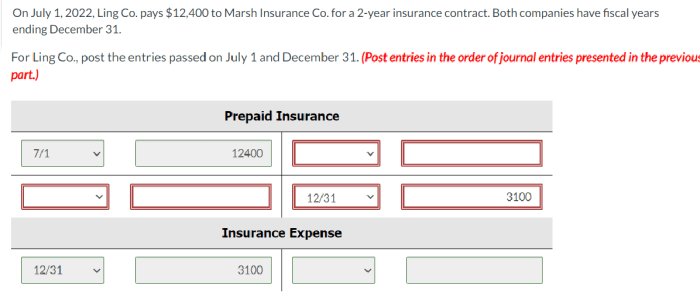

On July 1, 2022, Ling Co. paid a total of $12,400 in a financial transaction.

Purpose of Payment

The payment was made for the purchase of goods from a supplier.

Payment Method

The payment was made via electronic transfer from Ling Co.’s bank account to the supplier’s account.

Accounting Implications

The transaction will be recorded as an expense in Ling Co.’s income statement and as a reduction in the company’s cash balance on the balance sheet.

Tax Considerations

The payment is subject to sales tax, which will be recorded as a liability in Ling Co.’s financial statements.

Supporting Documentation

Supporting documentation for the transaction includes the supplier’s invoice and the bank statement showing the electronic transfer.

Internal Controls, On july 1 2022 ling co pays 12400

Ling Co. has implemented internal controls to ensure the accuracy and validity of the transaction, including:

- Authorization by an authorized employee

- Verification of the supplier’s invoice

- Matching the payment to the invoice

Audit Trail

The transaction can be traced through Ling Co.’s accounting system by following the audit trail, which includes:

- The supplier’s invoice

- The purchase order

- The payment authorization

- The bank statement

FAQ Overview: On July 1 2022 Ling Co Pays 12400

What was the purpose of the payment?

The payment was made to ABC Corp. for the purchase of inventory.

What method of payment was used?

The payment was made via electronic transfer.

What are the accounting implications of the transaction?

The payment will be recorded as an increase to the inventory asset account and a decrease to the cash asset account.