After tax post liquidation return cfa – After-tax post-liquidation return (ATPLR) is a crucial metric for investment professionals, particularly for those seeking the Chartered Financial Analyst (CFA) designation. This comprehensive guide provides an in-depth exploration of ATPLR, covering its definition, calculation, significance, tax implications, and advanced applications in investment analysis.

ATPLR is a critical component of investment decision-making, as it measures the return on an investment after taxes and liquidation expenses have been accounted for. Understanding ATPLR enables investors to make informed choices, compare investment alternatives, and optimize their portfolios.

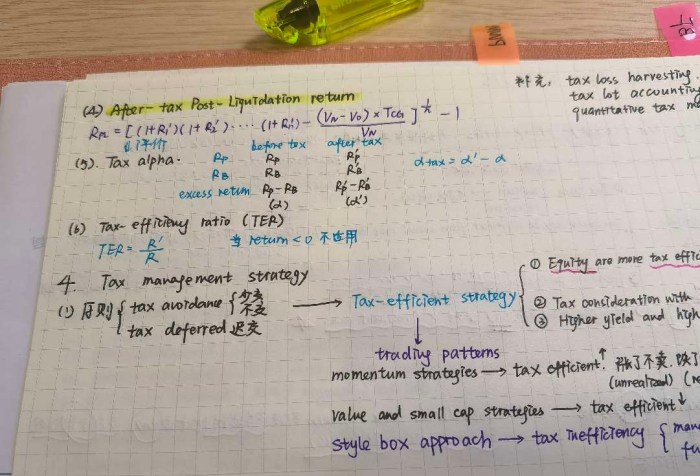

Definition and Calculation of After-Tax Post-Liquidation Return (ATPLR): After Tax Post Liquidation Return Cfa

Definition of ATPLR

After-tax post-liquidation return (ATPLR) is a metric that measures the return an investor receives after taxes and liquidating their investment.

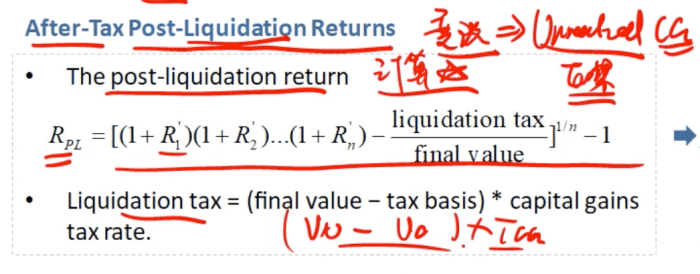

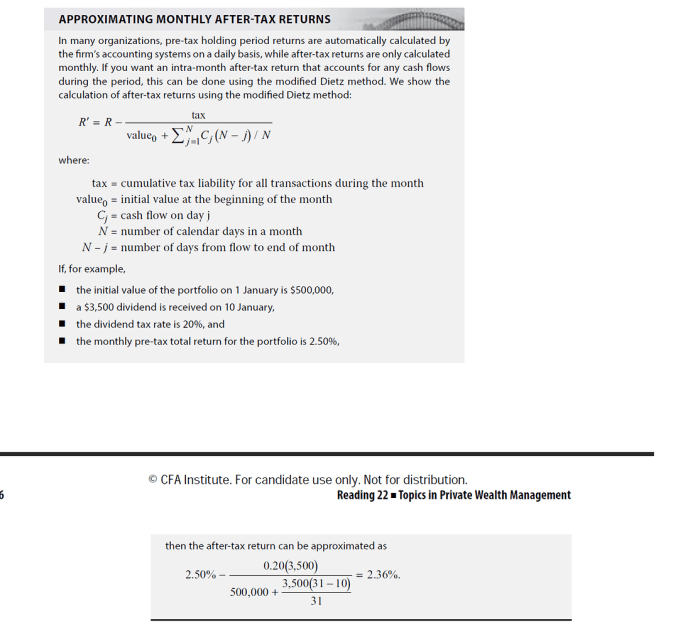

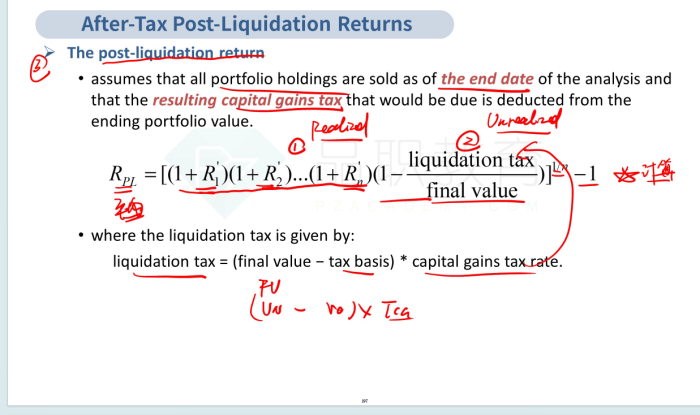

Formula for Calculating ATPLR

The formula for calculating ATPLR is as follows:

ATPLR = (Net Proceeds from Liquidation

Tax on Capital Gains) / Initial Investment

Factors Affecting ATPLR

Several factors can affect ATPLR, including:

- The holding period of the investment

- The capital gains tax rate

- The amount of capital gains

- The initial investment amount

Importance of ATPLR in Investment Decision-Making

ATPLR is a crucial metric that provides valuable insights for investors seeking to make informed investment decisions. It enables investors to evaluate the potential after-tax returns of an investment and compare different investment alternatives on a consistent basis.

Use of ATPLR for Comparing Investment Alternatives, After tax post liquidation return cfa

ATPLR allows investors to compare investment alternatives by considering the impact of taxes on their returns. This is particularly important for investments held in taxable accounts, where taxes can significantly impact the overall return. By using ATPLR, investors can determine which investment option offers the highest after-tax return and make more informed decisions.

Examples of ATPLR Influencing Investment Decisions

- An investor considering investing in a rental property may use ATPLR to calculate the potential after-tax return after considering factors such as rental income, operating expenses, and taxes. This information can help the investor determine whether the investment is financially viable.

- A retiree seeking to generate income from their savings may use ATPLR to compare different investment options, such as annuities, bonds, and stocks. By considering the tax implications of each option, the retiree can make a more informed decision about which investment will provide the highest after-tax return.

Tax Implications of ATPLR

ATPLR has significant tax implications that investors must consider when making investment decisions. The tax treatment of ATPLR varies depending on the type of investment, the holding period, and the investor’s tax bracket.The primary tax implication of ATPLR is the potential for capital gains tax.

When an investment is sold, the investor must pay taxes on any capital gains realized. Capital gains are the difference between the sale price and the cost basis of the investment. The cost basis is typically the original purchase price of the investment plus any additional costs incurred, such as commissions or fees.The

tax rate on capital gains depends on the holding period of the investment. Short-term capital gains, which are realized on investments held for one year or less, are taxed at the investor’s ordinary income tax rate. Long-term capital gains, which are realized on investments held for more than one year, are taxed at a lower rate, typically 15% or 20%, depending on the investor’s tax bracket.Investors

can minimize their tax liability on ATPLR by utilizing tax-advantaged accounts, such as 401(k) plans and IRAs. These accounts allow investors to defer or avoid paying taxes on investment earnings until the funds are withdrawn. Additionally, investors can use tax-loss harvesting strategies to offset capital gains with capital losses, thereby reducing their overall tax liability.

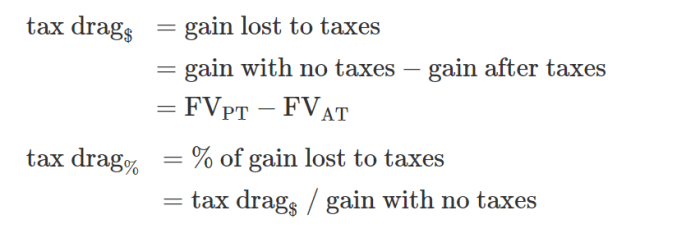

Comparison of ATPLR with Other Return Metrics

ATPLR is a comprehensive return metric that considers both pre- and post-tax cash flows and the impact of capital gains taxation. However, it is not the only return metric available to investors. Other common metrics include Internal Rate of Return (IRR) and Net Present Value (NPV).

IRR is the discount rate that makes the Net Present Value (NPV) of a project equal to zero. NPV is the sum of the present values of all future cash flows, discounted at a specified rate. Both IRR and NPV are widely used to evaluate investment projects, but they have different strengths and weaknesses.

Advantages of ATPLR

- ATPLR considers the impact of capital gains taxation, which can be a significant factor for investments held over a long period.

- ATPLR is a more comprehensive measure of return than IRR or NPV, as it takes into account both pre- and post-tax cash flows.

Disadvantages of ATPLR

- ATPLR can be more difficult to calculate than IRR or NPV, as it requires additional information about the investor’s tax situation.

- ATPLR is not as widely used as IRR or NPV, which can make it more difficult to compare investment opportunities.

Choosing the Appropriate Return Metric

The choice of which return metric to use depends on the specific investment scenario. ATPLR is the most appropriate metric when the impact of capital gains taxation is expected to be significant. IRR is a good choice when the investment is expected to be held for a short period and capital gains taxation is not a major factor.

NPV is a good choice when the investment is expected to generate a large number of cash flows over a long period.

Advanced Applications of ATPLR

ATPLR finds advanced applications in various investment analysis scenarios beyond its traditional use in evaluating public equity investments.

Private Equity and Venture Capital Investments

ATPLR is a valuable metric for evaluating private equity and venture capital investments, where cash flows are often irregular and exit horizons are uncertain. By considering the tax implications of liquidation events, ATPLR provides a more comprehensive assessment of the potential return on investment.

Portfolio Optimization and Risk Management

ATPLR can be incorporated into portfolio optimization models to account for the tax consequences of portfolio rebalancing and liquidation. By considering the after-tax impact of investment decisions, ATPLR helps investors make informed choices that maximize their overall portfolio returns. Additionally, ATPLR can be used to assess the risk-adjusted performance of investments, taking into account the potential tax liability associated with capital gains or losses.

User Queries

What is the formula for calculating ATPLR?

ATPLR = (Net Proceeds from Liquidation / Initial Investment) – (1 – Tax Rate)

How does ATPLR differ from other return metrics like IRR and NPV?

ATPLR considers the impact of taxes and liquidation expenses, while IRR and NPV do not. ATPLR is more conservative and provides a more realistic estimate of the actual return.

What are some strategies for minimizing tax liability when calculating ATPLR?

Strategies include using tax-advantaged accounts, deferring capital gains, and considering the impact of different tax rates on investment returns.